Minimum wage and living wage laws can create a deadweight loss by causing employers to overpay for employees and preventing low-skilled workers from securing jobs.

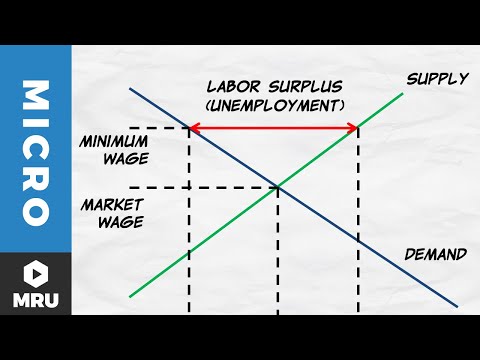

Q. What happens when the minimum wage is set above the equilibrium wage?

Minimum wage behaves as a classical price floor on labor. Standard theory says that, if set above the equilibrium price, more labor will be willing to be provided by workers than will be demanded by employers, creating a surplus of labor, i.e. unemployment.

Table of Contents

- Q. What happens when the minimum wage is set above the equilibrium wage?

- Q. What is the result when a minimum wage is introduced that is above the equilibrium wage rate if a minimum wage is introduced that is above the equilibrium wage rate _______?

- Q. What is deadweight loss in minimum wage?

- Q. What is the value of the deadweight loss from taxation?

- Q. What determines the size of deadweight loss?

- Q. Why does a tax create a deadweight loss what determines the size of this loss?

Q. What is the result when a minimum wage is introduced that is above the equilibrium wage rate if a minimum wage is introduced that is above the equilibrium wage rate _______?

Terms in this set (10) If a minimum wage is introduced that is above the equilibrium wage rate, job search activity increases.

Q. What is deadweight loss in minimum wage?

A deadweight loss is said to occur whenever economic activity that might otherwise have occurred is prevented from occurring because of policies that interfere with the natural functioning of a market economy. …

Q. What is the value of the deadweight loss from taxation?

However, taxes create a new section called “tax revenue.” It is the revenue collected by governments at the new tax price. As illustrated in the graph, deadweight loss is the value of the trades that are not made due to the tax.

Q. What determines the size of deadweight loss?

Deadweight loss is the fall in total surplus that results when a tax distorts market outcome. What factors determine the size of the deadweight loss? Elasticity of supply and demand determine deadweight loss. When supply is relatively inelastic, the deadweight loss of a tax is small.

Q. Why does a tax create a deadweight loss what determines the size of this loss?

Why does a tax create a deadweight loss? The tax raises the price consumers pay and lowers the price producers receive, which reduces the quantity demanded and supplied below the free-market equilibrium, creating a deadweight loss. The size of the loss depends on the elasticity of demand and supply.